At the Board of Directors meeting held on April 9, 2019 and chaired by Sophie Bellon, the Board closed the Consolidated accounts for the First Half of Fiscal 2019 ended February 28, 2019.

- Organic growth at +3.1%, slightly above expectations;

- All growth KPIs improved;

- Underlying Operating Margin as expected;

- Guidance maintained.

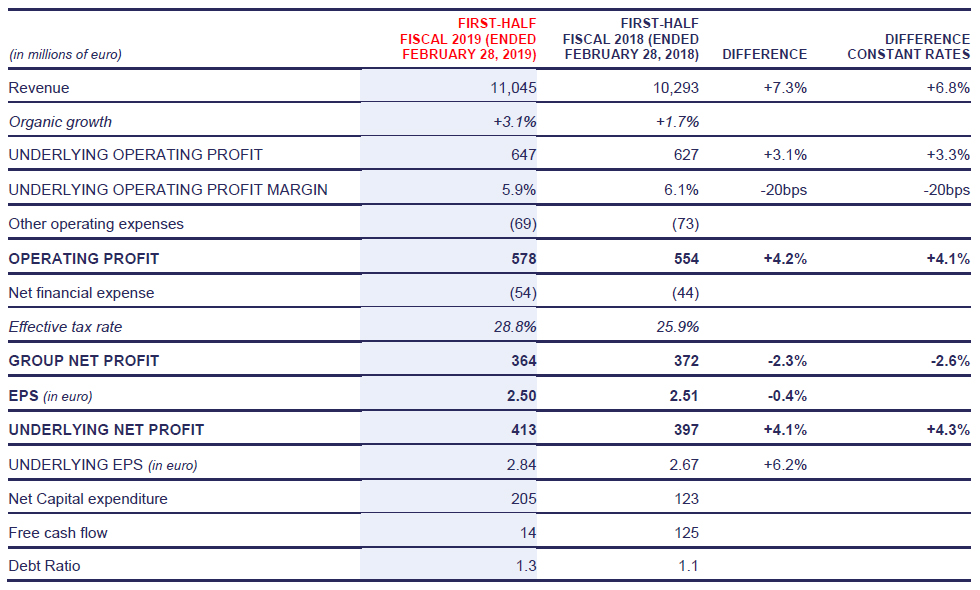

Financial performance for First Half Fiscal 2019:

Sodexo CEO, Denis Machuel, said:

“Growth has been encouraging in the second quarter in both Onsite Services and Benefits & Rewards. Client retention, development and same site sales growth KPIs are all improving. The margin is down slightly in Onsite Services, as expected, and up slightly in Benefits & Rewards. We have accelerated our capital expenditure in the Education and Sports & Leisure segments. These are good signs that our focus on growth agenda is beginning to move the cursor.

I am pleased with the progressive improvement in growth in North America, in Q1 and then in Q2. Steady progress is being made by the new Health Care North America team in reasserting discipline and accountability throughout the organization. We are also achieving strong growth in Brazil both in the Benefits & Rewards business as well as Onsite, helped by an improving economic environment.

We maintain our guidance both in top line organic growth and underlying operating profit margin.”

Highlights of the period

- Organic revenue growth for the First Half Fiscal 2019, at +3.1%, was slightly better than expected, resulting from an encouraging second quarter performance at +3.6%, with growth accelerating in all segments, and in Benefits & Rewards Services.

- On-site Services organic revenue growth of +2.8% reflects:

• Growth in North America turned positive in the first quarter at +0.2%, and accelerated in the second quarter to +2.4%. Europe was solid at +3% and the region Africa, Asia, Australia, Latin America, Middle East continues to grow at +6.9%, despite the ever higher comparable base.

• All growth Key Performance Indicators are better year on year:

- Client retention is up +40 bps;

- New sales development increased + 70 bps;

- Same site sales growth is +20 bps.

- Benefits & Rewards Services organic revenue growth is +10.1%. Organic growth in Europe remains sustained at +8.2% and is strong in Latin America at +12.5%, as the economic environment improves steadily in Brazil.

- Underlying operating profit increased +3.1%, resulting in an underlying operating margin of 5.9%, down 20 bps at constant exchange rates, principally due to:

• A 30bps decline in On-site Services margins resulting from timing differences between investments in growth and expected efficiency gains, but also due to the renewal of the major Marine Corps contract in the USA.

• A 30bps improvement in Benefits & Rewards due to strong recovery in Brazil and lower digital migration costs, particularly in India, following the significant investment required last year.

- Other operating income and expenses amounted to 69 million euro, down from 73-million-euro last year.

- Reported net profit of 364 million euro was down -2.3%. Basic EPS was €2.50, down by only -0.4%, due to a lower share count as a result of the share buy-back in the previous fiscal year. Underlying Net profit totaled 413 million euro, up +4.1%.

- Free cash flow was 14 million euro, a normal level for the First Half, despite a substantial increase in capital expenditure, which reached 1.9% of revenues for the period. As a result, the net debt ratio at the end of the period was 1.3x against 1.1x at the end of the First Half last year.

- Acquisitions, net of disposals, amounted to 234 million euro, in First Half Fiscal 2019 with Crèche de France, doubling the Group’s presence in the child-care market in France, Novae Restauration, significantly enhancing the Group’s presence in the high-end catering market Switzerland, Pronep, with which we have entered the Brazilian home care market and Alliance in Partnership in the UK, a specialist education caterer, reinforcing our focus on high quality, locally sourced and seasonal meals at competitive prices.

- Sodexo’s engagement in corporate responsibility continues to be recognized within the investment community, with the highest marks in SAM’s “Sustainability Yearbook”, for the 12th consecutive year. Sodexo also remains the top-rated company in its sector within the Dow Jones Sustainability Index (DJSI), for the 14th consecutive year confirming Sodexo’s commitment to Quality of Life.

Board composition

The following changes to the board have been approved by the Board of Directors since the Annual General Meeting of the shareholders on January 22, 2019.

- Sophie Stabile has replaced Emmanuel Babeau as Chair of the Audit committee and has joined the Compensation Committee;

- Emmanuel Babeau has resigned from the Compensation Committee;

- Robert Baconnier has resigned from the Audit Committee;

- Cécile Tandeau de Marsac has replaced Françoise Brougher as Chair of the Nominating Committee.

As a result, the composition of the board committees is now as follows:

- Audit Committee:

• Sophie Stabile, Committee Chair, Independent Director

• Emmanuel Babeau, Independent Director

• François-Xavier Bellon

• Soumitra Dutta, Independent Director

• Cathy Martin, Director representing employees

- Nominating Committee:

• Cécile Tandeau de Marsac, Committee Chair, Independent Director

• Sophie Bellon

• Nathalie Bellon-Szabo

• Françoise Brougher, Independent Director

- Compensation Committee:

• Cécile Tandeau de Marsac, Committee Chair, Independent Director

• Sophie Stabile, Independent Director

• Françoise Brougher, Independent Director

• Philippe Besson, Director representing employees

- Following the recommendation of the Nominating Committee, the Board will propose, at the next Shareholders meeting, the appointment of Luc Messier as an independent Director of the company. Mr. Messier holds both Canadian and American citizenship, and will bring significant international operational experience, notably in the oil and gas sector, through executive management positions held with large French and American multinational companies (ConocoPhilips, Technip, Bouygues, Pomerlau). He has lived and worked in Asia, Africa, Europe, and North America, most recently for several years in the United States, where he currently resides.

Sodexo Chairwoman, Sophie Bellon, said:

“I am very pleased to propose Luc Messier as a new Board Member. He will bring valuable operational experience garnered from the different companies and countries in which he has worked, notably the United States.

Board renewal continues to be an important priority. Fostering new momentum, open discussions and best practice within the Boardroom are key to support and accelerate the execution of our strategy and the achievement of our objectives.”

Outlook

Growth in the First Half Fiscal 2019 of +3.1% was slightly above expectations. For the Second Half, we see continued growth in developing economies, although the comparable base is high, some contracts being exited and improvement in North America remaining challenging. Therefore, the Group maintains its objective of organic revenue growth of between 2 and 3%.

The action plans are being executed with a clear focus on growth and on margin protection to ensure that the underlying operating margin for the year should be between 5.5% and 5.7%, excluding the currency impact.

The strategic agenda is aimed at delivering market leading growth. The first steps to return to this performance are to achieve organic growth of more than 3% from Fiscal 2020. Margin improvement will come with the right levels of growth, the objective being a return to an underlying operating margin sustainably over 6%.

To read the full version of the press release, please download the PDF

- Press release (PDF)

- Presentation (PDF)

- Webcast

Conference Call

Sodexo will hold a conference call (in English) today at 9:00 a.m. (Paris time), 8:00 a.m. (London time) to comment on its results of First Half Fiscal 2019. Those who wish to connect from the UK may dial +44 (0) 207 192 8000 or from France +33 (0)1 76 70 07 94, or from the USA +1 866 966 1396, followed by the passcode 176 46 37.